PNC Online Banking: Your Comprehensive Guide to Digital Banking

In today’s fast-paced digital world, online banking has become a staple for managing finances efficiently and securely. PNC Bank, one of the largest financial institutions in the United States, offers a robust online banking platform that caters to both personal and business customers. In this blog, we’ll explore the features, benefits, and security measures of PNC Online Banking, and provide tips on how to make the most out of your online banking experience.

What is PNC Online Banking?

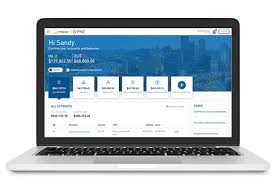

PNC Online Banking is a digital platform that allows customers to manage their bank accounts from the comfort of their homes or on the go. With a user-friendly interface and a plethora of features, PNC Online Banking aims to simplify the way you handle your finances. Whether you want to check your balance, transfer funds, pay bills, or deposit checks, PNC’s online banking services are designed to provide convenience and efficiency.

Key Features of PNC Online Banking

1. Account Management

PNC Online Banking allows you to view all your accounts in one place. You can easily monitor your checking, savings, and investment accounts, as well as credit card statements. This holistic view helps you keep track of your finances and make informed decisions.

2. Fund Transfers

Transferring money between PNC accounts or to accounts at other banks is straightforward. You can set up one-time transfers or schedule recurring payments. This feature is particularly useful for managing monthly bills or savings goals.

3. Bill Pay

The Bill Pay feature enables you to pay your bills directly through the PNC platform. You can set up one-time or recurring payments for various bills, ensuring you never miss a payment deadline. Additionally, you can add payees easily, making it simple to manage multiple bills.

4. Mobile Check Deposit

With the PNC Mobile Banking app, you can deposit checks directly from your smartphone. Simply take a picture of the front and back of the check, enter the amount, and submit it for deposit. This feature saves time and eliminates the need to visit a physical branch.

5. Alerts and Notifications

Stay informed about your account activity with customizable alerts. You can set up notifications for low balances, large transactions, and bill payment reminders. These alerts help you manage your finances proactively and avoid potential overdraft fees.

6. Financial Tools

PNC Online Banking includes various financial management tools that can help you budget, track spending, and plan for future expenses. The virtual financial advisor can provide insights based on your spending habits and suggest ways to save more effectively.

7. Security Features

PNC places a strong emphasis on security. Their online banking platform employs advanced encryption technology to protect your sensitive information. Additionally, features like two-factor authentication and automatic log-off after a period of inactivity enhance your account’s security.

Benefits of Using PNC Online Banking

Convenience

The most significant advantage of online banking is the convenience it offers. You can manage your finances anytime, anywhere, without the need to visit a physical branch. Whether you’re at home, at work, or traveling, your bank is just a click away.

Time-Saving

Online banking eliminates the need for long queues at the bank. You can complete transactions, pay bills, and check your balances in a matter of minutes. This efficiency allows you to focus more on your daily activities rather than banking chores.

Cost-Effective

With online banking, many transactions can be performed without incurring fees. For example, online bill payments and fund transfers are often free, helping you save money in the long run.

Access to Information

PNC Online Banking provides instant access to your account statements, transaction history, and financial reports. This level of access enables you to track your financial health and make informed decisions quickly.

Enhanced Financial Management

The budgeting and financial tools available through PNC Online Banking allow you to take control of your finances. By understanding your spending patterns and setting savings goals, you can work towards a more secure financial future.

Getting Started with PNC Online Banking

Step 1: Enroll

To begin using PNC Online Banking, you’ll need to enroll. Visit the PNC website and click on the “Enroll” button. You’ll be prompted to provide some personal information, including your Social Security number, date of birth, and account details.

Step 2: Set Up Your Profile

Once you’ve completed the enrollment process, you can set up your online profile. This includes creating a username and password, as well as selecting your security questions. Make sure to choose a strong password to enhance your account’s security.

Step 3: Download the Mobile App

For on-the-go banking, download the PNC Mobile Banking app from the App Store or Google Play. The app offers most of the features available on the website, making it easy to manage your finances from your smartphone.

Step 4: Explore the Features

Take some time to explore the various features of PNC Online Banking. Familiarize yourself with account management, bill pay, fund transfers, and financial tools. The more comfortable you are with the platform, the more effectively you can manage your finances.

Security Measures for Online Banking

While PNC Online Banking is designed with security in mind, it’s crucial for users to take their own precautions. Here are some tips to ensure your online banking experience is safe:

1. Use Strong Passwords

Create a unique, complex password that includes a mix of letters, numbers, and symbols. Avoid using easily guessed information like birthdays or common words.

2. Enable Two-Factor Authentication

PNC offers two-factor authentication for an added layer of security. This feature requires you to verify your identity through a secondary method, such as a text message or email, when logging in.

3. Monitor Your Accounts Regularly

Regularly check your account statements and transaction history for any unauthorized activity. If you notice anything suspicious, report it to PNC immediately.

4. Keep Your Devices Secure

Ensure your devices have updated antivirus software and are protected with strong passwords. Avoid accessing your bank accounts over public Wi-Fi networks, as they can be less secure.

5. Log Out After Use

Always log out of your account when you’re finished, especially on shared or public devices. This simple step can prevent unauthorized access to your account.

Conclusion

PNC Online Banking offers a wide array of features designed to make managing your finances easier and more convenient. With its user-friendly interface, robust security measures, and valuable financial tools, PNC Online Banking stands out as a top choice for those looking to simplify their banking experience. By taking advantage of its features and practicing good security habits, you can enjoy the benefits of online banking while keeping your financial information safe. Embrace the digital banking revolution and take control of your finances with PNC Online Banking today!